Your Guide to Apportioned Plates and IRP Services from Vehicle Licensing Consultants

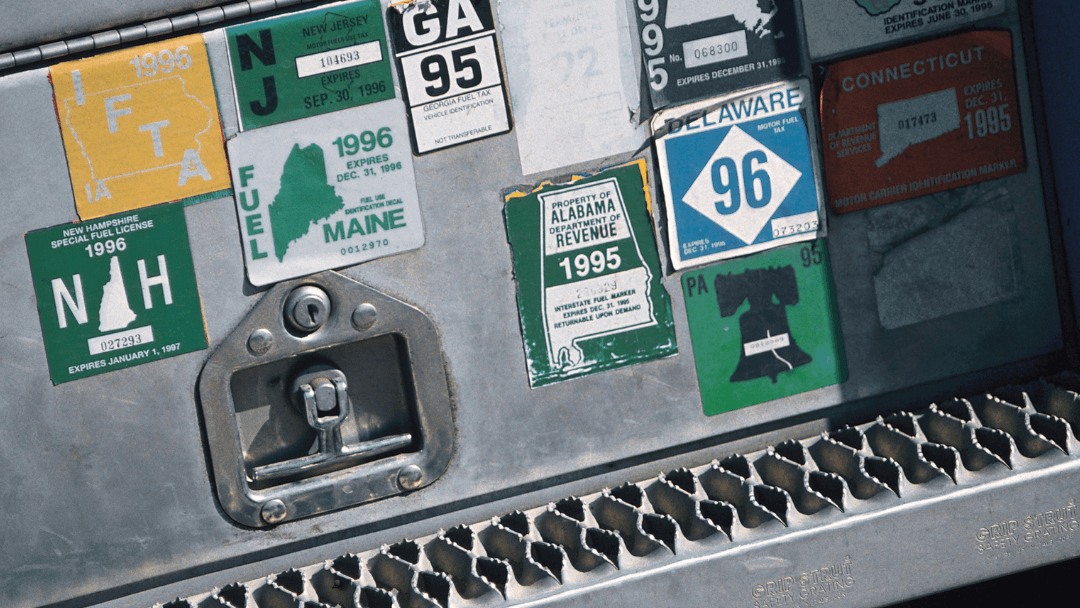

Ensuring compliance with state regulations is one of the most important things you can do for the successful operation of your fleet company. That’s where we come in at Vehicle Licensing Consultants. We are proud to be your trusted partner in navigating the often-complicated world of apportioned plates, California International Registration Plan (IRP) services, and other licensing requirements from states across the country as well.

As an authorized business partner of the California Department of Motor Vehicles (DMV), it is especially important to us to deliver efficient and reliable solutions to trucking companies everywhere, helping you and your team stay on the road – and in compliance.

California Apportioned Plates – A Hassle-Free Operation

At Vehicle Licensing Consultants, we understand the challenges faced by trucking companies in obtaining and renewing California apportioned plates. As an authorized agent, we offer a simple process to make sure you receive your apportioned plates, IRP stickers, decals, and cab-cards within 24 hours. Our close partnership with the California DMV means you can trust us to handle your apportioned plate needs with accuracy and speed so there is never a gap in compliance. After all, lost time on the road is lost profit for your business!

Comprehensive Registration and Titling Services Across States

Our commitment to simplifying your trucking operations goes far beyond California. At Vehicle Licensing Consultants, we are very well equipped to provide registration and titling services in numerous other states across the country, saving you both time and confusion. Whether you operate solely within California or across state lines, we can help.

IFTA Licensing Requirements

For trucking companies, how to file IFTA online in California is a topic we frequently receive questions about. FTA stands for International Fuel Tax Agreement. The experts on our team are well-versed in the intricacies of IFTA requirements, which means they can guide your company to help you meet your obligation with ease and timeliness. Should you have any questions, we can help you step by step through the process. Our goals are to make online filing a breeze, to make sure that you maintain compliance, and to decrease your stress.

Demystifying State-Specific Requirements

In addition to IFTA, our services at VLC extend to addressing various state-specific requirements including but not limited to the following:

- Kentucky Highway Use License Requirements – If a vehicle is 60,000 lbs or more, these license requirements are required. Vehicles who qualify must file a tax report quarterly and pay the correct amount of taxes. In addition, any carriers whose licenses have been canceled must obtain a surety bond.

- New Mexico Weight Permit – If registered commercial vehicles (both intra and interstate) have a weight of over 26,000 lbs, a weight-distance tax is imposed. The amount is calculated based on both weight and miles traveled, and companies must stay on top of registering for this permit.

-

- New York Highway Use Tax – This tax is determined based on the weight of the vehicle and the mileage traveled, and is needed for any tractor, truck, or “self-propelled” vehicle with a weight over 18,000 lbs. A decal must be affixed to the vehicle proving registration as well. Check out this link to learn more! http://www.tax.ny.gov/bus/hut/huidx.htm

- Arkansas Ad Valorem Tax – An ad valorem tax means “according to worth” and the Tax Division of the Arkansas Public Service Commission determines this tax on motor carriers in the state.

- Oregon Requirements – When entering the state of Oregon or traveling through it, trucking carriers with more than 26,000 lbs of weight are required to hold a temporary pass or Oregon Weight Receipt along with a Tax Identifier for each unit. In addition, fleet companies must report the miles traveled and pay the correct weight-mile tax quarterly or monthly to the Oregon Department of Transportation. The Oregon DOT requires that companies post a bond which can be dismissed after timely reporting is completed.

- Temporary Passes – The Oregon DOT has also implemented temporary permit restrictions. The DOT can only issue five permits per vehicle or 35 per account within one year, and customers who exceed this limit must establish an account.

- Kansas Motor Carrier Property Tax – The state of Kansas requires a filing from every company which was listed as a motor carrier on January 1 of the current year and who used, owned, or operated any rolling equipment or over-the-road motor vehicles in the state during the preceding year.

VLC – Your Trusted Partner in Trucking Compliance

With Vehicle Licensing Consultants as your partner, you can confidently manage regulations so you are certain that your fleet can operate smoothly and within legal bounds.

Trucking companies nationwide rely on Vehicle Licensing Consultants to handle their regulatory needs because our expertise in obtaining California apportioned plates, providing comprehensive IRP services, and navigating taxes and regulations in multiple states sets us apart as one of the most reliable partners in the trucking industry. Give us a call so that we can begin helping you simplify the compliance process and keep your trucks on the road.

You can reach us directly at (530) 637-1696 or by emailing info@im4trux.com