interstate Compliance Services

IRP | IFTA | UCR | 2290 | DOT

IRP/Apportioned Plate & IFTA Solutions for Growing Fleets

Keeping your fleet compliant across multiple states isn’t just about filing paperwork—it’s about protecting your business from audits, delays, and costly violations. Vehicle Licensing Consultants (VLC) simplifies the entire process of staying legal on the road with customized support and technology-driven compliance services.

✅ IRP / Apportioned Plates Management

From setting up new IRP accounts to managing renewals, replacements, and jurisdiction changes, we handle every aspect of apportioned plate compliance—so your fleet stays legal and on the road.

Our services include:

-

IRP account setup for new fleets

-

First-time apportioned plate registration

-

Plate renewals and cab card updates

-

Replacement and duplicate plates

-

Vehicle additions, removals, and changes

-

Jurisdiction management and reporting

-

Ongoing compliance calendar tracking

-

Real-time tracking through your fleet portal

✅ IFTA (International Fuel Tax Agreement)

No more spreadsheets or guesswork. VLC takes the complexity out of quarterly IFTA filings with expert support and streamlined data collection.

We help with:

- New IFTA license setup and renewal

- Fuel tax reporting and quarterly filings

- Mileage reconciliation and record keeping

- Multi-state compliance assurance

✅ Additional State Permits

(Oregon, New Mexico, New York, Connecticut)

We offer services for permit and account opening and monthly/ quarterly and annual filings for special state travel permits as well.

✅ Seamless IFTA Mileage Tracking with Geotab Integration

We simplify IFTA compliance by integrating directly with your Geotab telematics system. This connection ensures accurate, automated mileage tracking across jurisdictions—eliminating manual entry errors and saving you valuable time during quarterly filings.

Why Fleets Choose VLC

We’re not a one-size-fits-all service. We specialize in helping fleet compliance managers, licensing coordinators, and operations directors—not independent drivers—scale compliance without the stress.

What sets us apart:

🧠 30+ Years of Licensing Experience

📊 Fleet-Focused Portals with Alerts & Tracking

🤝 Real Experts on Call — No Chatbots

🌐 Tech-Enabled Tools Like DQM Connect & Gateway Connect

Integrated Tech for Smarter Compliance

Whether you manage a 20-truck regional fleet or a 500-truck enterprise, VLC’s tools give you control and visibility.

- DQM Connect™: Automates driver file management and alerts you to upcoming expirations

- GW Connect™: Highlight missing miles and truck data for IRP/IFTA filings. Integrated with your ELD provider.

“Managing IRP and IFTA used to be a mess. With VLC, we just log in and know where we stand.”

Schedule a Free Demo

Let’s take the guesswork out of IRP, IFTA, and apportioned plate management.

Annual State Permits

IFTA License

International Fuel Tax Agreement re-distributes fuel taxes based on the percentage of miles traveled in each state. Companies are required to collect mileage and fuel for each jurisdiction and file quarterly tax reports.

Qualified motor vehicles include:

- three or more axles; or

- two axles and a gross vehicle vehicle weight (GVW) of 26,001 or more pounds; or

- Is used in a combination that has a combined or registered gross vehicle weight of 26,001 or more pounds

For more information visit: www.cdtfa.ca.gov

IFTA covers fuel taxes only. It does not cover road taxes, weight mileage taxes, or any other jurisdiction specific taxes. You must continue to pay these taxes directly to the jurisdictions in which you travel, i.e. Kentucky, Oregon, New Mexico, New York

Kentucky Highway Use License (KYU)

This license is required for vehicles with a registered gross weight of 60,000 lbs. and above to report mileage tax. A surety bond is only required for carriers whose license has been cancelled for any reason. Qualified vehicles must file a quarterly tax report and pay appropriate taxes.

New Mexico Weight Permit

New Mexico imposes a weight-distance tax on owners, operators, and registrants of intra and interstate commercial vehicles with a declared gross vehicle weight in excess of 26,000 pounds. This tax is based on vehicle weight and miles traveled on New Mexico roads. Companies must register and apply each year for a New Mexico Weight Distance Permit.

New York Highway Use Tax (HUT)

The New York Highway Use Tax (HUT) is imposed on motor carriers operating certain motor vehicles on New York State public highways. The tax is based on mileage traveled at a rate determined by the weight of the motor vehicle. A HUT certificate of registration is required for any truck, tractor, or other self-propelled vehicle with a gross weight in excess of 18,000 pounds. As of January 1, 2013, you must affix a decal to each vehicle that’s required to have a certificate of registration. For more information visit: http://www.tax.ny.gov/bus/hut/huidx.htm

Oregon

When traveling in Oregon or entering Oregon, carriers must obtain tax and registration credentials prior to operating. The only exception is if entering Oregon on I-5 @ OR/WA border and going directly to Portland Bridge Office at Jantzen Beach and purchasing credentials. Office is open M-F 8:00 am to 5:00 pm.

Carriers operating vehicles in Oregon with a combined weight 26,001 or more GVW must have either a valid temporary pass or an Oregon Weight Receipt and Tax Identifier for each power unit. Companies are required to report Oregon road miles and pay the appropriate weight-mile tax either monthly or quarterly to the Oregon Department of Transportation. ODOT requires the posting of a bond, which may be dismissed after demonstration of timely reporting.

Temporary Passes: Oregon DOT has implemented restrictions to temporary permits. Only 5 per vehicle or 35 per account within one year may be issued. Customers exceeding this limit will be required to establish an account.

Arkansas Ad Velorem Tax

The Tax Division of the Arkansas Public Service Commission determines Ad Valorem Assessments for property tax purposes on motor carriers.

Ad valorem simply means “according to worth.” The term ad valorem can apply to any tax, fee, or duty that is charged as a percentage of the value of products, services, or property.

Kansas Motor Carrier Property Tax

K.S.A. 79-6a requires a filing from every entity which was a motor carrier on January 1 of the current year and who owned, used or operated any over-the-road motor vehicles or rolling equipment in the state of Kansas during the preceding year.

Interstate Permits

New Entrant Program

All first-time carrier applicants for a USDOT Number will be automatically enrolled in the FMCSA New Entrant Safety Assurance Program. This program requires new entrants to pass a safety audit and maintain acceptable roadside safety performance over an initial 18-month period before they are given permanent registration status. In most cases, companies operating exclusively as brokers or non-vehicle-operating shippers or freight forwarders do not need to obtain a USDOT Number.

USDOT Numbers

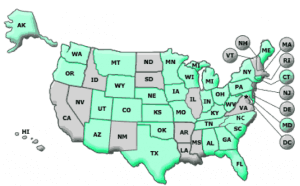

In select states (see green highlighted states or list below), all registrants of commercial motor vehicles, even intrastate and non-Motor Carrier registrants, are required to obtain a USDOT Number as a necessary condition for commercial vehicle registration.

Alabama, Alaska, Arizona, Colorado, Connecticut, Florida, Georgia, Indiana, Iowa, Kansas, Kentucky, Maine, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Nebraska, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming.

Interstate Operating Authority and Financial Responsibility

Companies that operate as “for hire” carriers (for a fee or other compensation) that transport passengers or federally regulated commodities, or arrange for their transport, in interstate commerce are also required to have interstate operating authority.

The Reach of Operating Authority

FMCSA operating authority is also referred to as an “MC,” “FF,” or “MX” number, depending on the type of authority that is granted. Unlike the USDOT Number application process, a company may need to obtain multiple operating authorities to support its planned business operations. Operating Authority dictates the type of operation a company may run and the cargo it may carry.

Filing UCR

Unified Carrier Registration (“UCR”) is a mandatory registration program that applies to all private and for-hire motor carriers that operate in interstate commerce. If you are an interstate carrier and file UCR, you will need to file a non-expiring Motor Carrier Permit (MCP).

For more information visit:https://plan.ucr.gov/registration/

Financial Responsibility and Exemptions

All of this also dictates the level of insurance/financial responsibilities a company must maintain. Carriers not required to have operating authority include Private carriers, “for-hire” carriers that exclusively haul exempt commodities (cargo that is not federally regulated), or carriers that operate exclusively within a federally designated “commercial zone” that is exempt from interstate authority rules. A commercial zone is, for example, a geographic territory that includes multiple states bordering on a major metropolitan city, such as Virginia/Maryland/Washington, DC.

For more information visit: www.fmcsa.dot.gov

2290 Heavy Highway Use Tax

2290 Form, Heavy Highway Vehicle Use Tax (HHVUT) is to be filed and paid annually for every truck / tractor using public highways and weighs 55,000 or more lbs. VLC files 2290’s electronically and will provide a stamped receipted copy to keep in your truck. VLC will also keep an electronic copy on file as a back up. The 2290 form is required for all registration renewals.

The 2290 Form is due annually on August 31 for the period of July 1 – June 30.

This tax must also be paid anytime a new vehicle is added to your fleet for the remainder of that year. In this case the tax is due by the end of the month following the date the vehicle is first used on the public highways.

For more information visit: www.irs.gov/instructions/i2290/

Other Services We Provide

Tax Reporting

Mileage and fuel tax reporting

Intrastate Services

California credentials in 24 hours

2290 Heavy Highway Use

Heavy Highway Vehicle Use Tax